The American Midwest is increasingly becoming the home of technology startups. But how do Midwestern cities stack up against each other?

To find out, we have to look at the number of startups and venture capital funding in the area. Furthermore, we will be summarizing the findings from data collected by CrunchBase.

When we talk about Midwestern states, we’re talking about the following:

- Illinois

- Indiana

- Iowa

- Kansas

- Michigan

- Minnesota

- Missouri

- Nebraska

- North Dakota

- Ohio

- South Dakota

- Wisconsin

What are the key measures?

To measure venture capital and startup activity in the region, the following were set as key measures:

- The number of startups that were founded over a period of two and half years;

- The total number of venture capital rounds and the number of dollars raised by startups in the region;

- The number of investors based in each city.

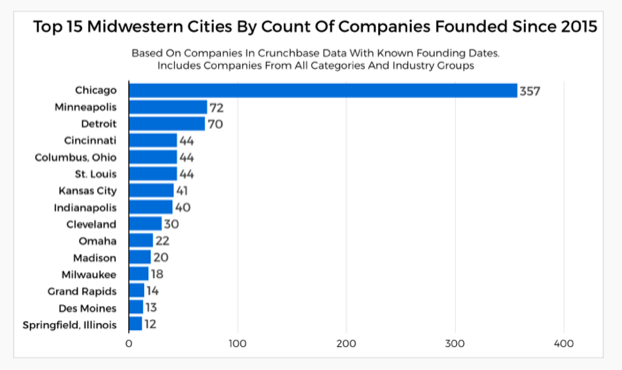

Between January 2015 and July 2017, CrunchBase found that exactly 1,000 startups were founded in the Midwest. These were aggregated around metropolitan regions.

However, it’s important to note that some of the numbers below might be a little skewed as not all the companies in the area had founding dates that were publicly listed. This means that there might have been several more startups that didn’t make it into the study.

Image source: CrunchBase, 2017

No matter what, the data above confirms that Chicago has a significant lead over its nearest competitor, Minneapolis. In fact, the windy city is home to five times as many tech startups!

Although Minneapolis has a population that is 30% higher (and financially better off) than Detroit, both cities saw roughly the same amount of companies spring up during the same period of time.

Investment rounds

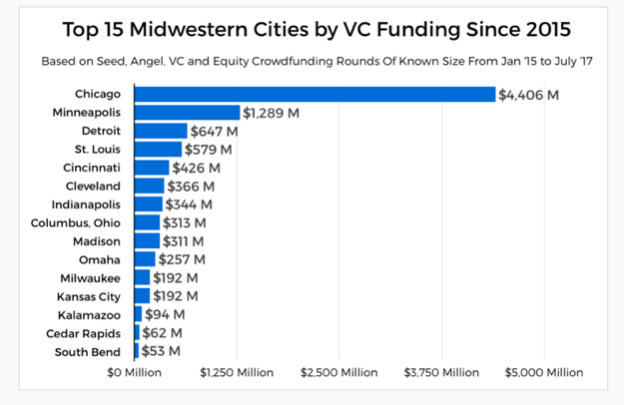

After analyzing over 2,400 venture capital deals in the Midwest over two and a half years, again, Chicago came up on top (by a significant margin). However, over this same period of time, Chicago only had a little over three times as many venture rounds as Minneapolis.

How do these metro Midwestern cities rank by funding?

Out of 2,400 deals that were analyzed, only about 1,840 of them had a monetary figure associated with them. So the actual amount of money invested will be a lot higher, but at the same time, there is enough here to assume that these findings are sound.

Image source: CrunchBase, 2017

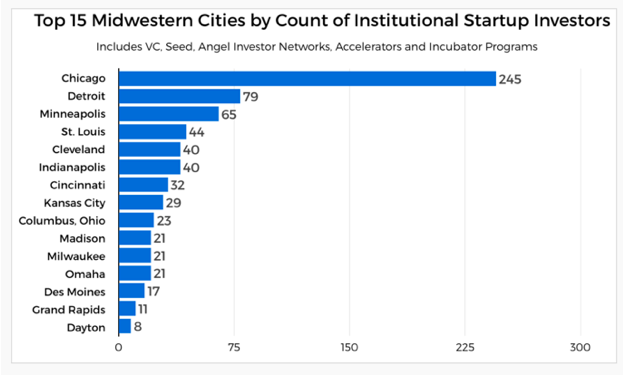

The number of venture investors in the area

This study only focused on institutional investors, specifically venture capitalists (both micro VCs and regular VCs), incubators, investor networks, seed funds, and accelerators.

Image source: CrunchBase, 2017

As you can see, Chi-Town has a significant lead over its neighbors when it comes to these specific variables. Furthermore, being the biggest city in the region (and a major financial center), it makes sense that the windy city is also home to the highest number of institutional investors.

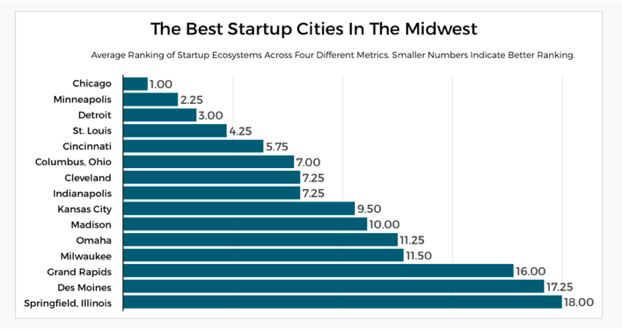

Image source: CrunchBase, 2017

What’s more, when you bring it all together, it’s also no surprise that Chicago is by far the best startup city in the Midwest!